Published

11/01/2024, 17:22Baidu Inc. (NASDAQ: BIDU), one of China's leading technology companies, continues transforming its business by concentrating on artificial intelligence (AI) innovations and autonomous driving. This allows the company to significantly reduce its dependence on advertising and strengthen its position in high-tech segments. The use of AI not only diversifies revenue sources but also improves the overall efficiency of Baidu's operations, opening up new prospects in the global market.

The material is not a call to buy Baidu Inc. shares. Royal Inc. analysts' estimates are informative only. The stock market is subject to the influence of various factors, including economic, political and market risks, which can lead to unpredictable results. Therefore, all decisions to purchase shares should be made by the investor independently, accounting for all possible risks and his or his/her financial situation.

Baidu is a diversified technology company operating the largest search engine in China. A significant part of its revenue comes from its advertising business. In addition, Baidu owns iQIYI, one of the largest streaming platforms.

In recent years, the company has been going through a major transformation, shifting its focus from traditional internet services to artificial intelligence (AI) with a particular focus on autonomous driving technologies. So, today, artificial intelligence is the backbone of Baidu's business, especially within the Baidu Core division, which contributed more than 70 % of the company's revenue between 2021 and 2023.

Baidu Core's core revenues are related to online marketing based on search queries, news feeds, and products and services developed through new AI initiatives. These initiatives focus on three key areas: the mobile ecosystem, which includes more than a dozen applications such as the Baidu App and ERNIE Bot, a feature-rich AI assistant for PCs and mobile devices; the AI cloud, Baidu provides cloud solutions for businesses and the public sector. This segment includes IaaS, PaaS and SaaS products; smart driving and new growth areas, which include Apollo Go autonomous taxi, Baidu Apollo autonomous driving solutions, and a joint venture with Geely to develop smart electric vehicles, Xiaodu smart devices and AI chips.

According to Royal Inc. chief analyst Ruslan Idyrov the company's growth drivers today are ERNIE Bot, the Apollo project and Baidu's strong positions in AI and cloud services.

"ERNIE Bot could become an important source of revenue growth for the company. At the end of June, Baidu presented the ERNIE Bot 4.0 Turbo updated version. The number of its users has already reached 300 million. In mid-June, talks between Baidu and Apple on a potential partnership in the Chinese artificial intelligence market were also renewed. Given restrictions on the Chat GPT use in China, this partnership could be very significant for Baidu,' Ruslan Idyrov thinks.

Furthermore, Royal Inc.'s chief analyst notes through the Apollo Go service, Baidu can capitalise on this growing autonomous driving market.

‘According to Fortune Business Insights, the autonomous driving market will grow at a CAGR of 32% in the next six years and reach $39 billion by 2030. Against this backdrop, Apollo's autonomous car project is attracting great attention,’ he went on.

In addition, as the expert notes, the company today has quite a strong position in AI and cloud services. Thus, the company's AI-based cloud services are showing rapid growth. All thanks to the fact that Baidu is actively investing in research and development in artificial intelligence, including improving its search engine, and creating cloud platforms for machine learning and intelligent solutions for various industries. This, which is important, helps the company to diversify its revenues, and thus reduce its dependence on the advertising business.

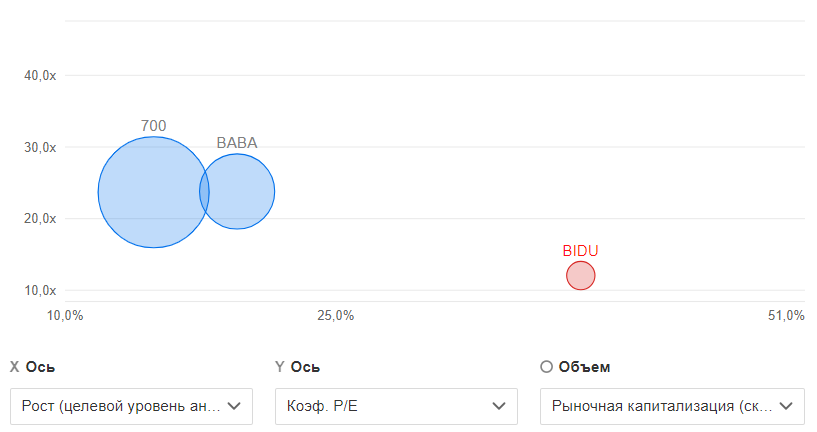

At the same time, the company now has a fairly low valuation compared to other Chinese tech giants such as Alibaba and Tencent.

"Baidu's stock is trading at lower multiples, which makes it attractive to investors. With a current price of $95.27, the stock is projected to rise to $131.77, suggesting an upside potential of 38.31%. However, despite the positive outlook, it is important to consider some risks. These include both the legal uncertainty of the company's structure and U.S. regulatory requirements that could lead to delisting. Additionally, geopolitical tensions between the US and China could limit Baidu's access to key technologies and markets,’ the expert concluded.

Notwithstanding potential risks, today Baidu keeps adapting to changing conditions and innovating to remain one of the leaders in AI and autonomous technologies. Its future depends on its ability to cope with external challenges and continue its high-tech directions' expansion.