Published

03/21/2025, 09:06RISE Research in cooperation with EA Group Holding, MA7 Ventures, BGlobal Ventures (a subsidiary of Qazaqstan Investment Corporation JSC), KPMG and dealroom.co, conducted a large-scale research of the venture capital market in Central Asia for 2024. More than 200 startups and 40 venture capitalists and market experts participated in the study.

According to the data obtained, the venture capital market in Central Asia continues to grow. The total amount of venture deals in the region for 2024 reached $95 million, which is 7% more than in 2023.

“The Central Asian startup market is actively developing, opening up new opportunities for international investors. At MA7 Angels Club we are already pooling capital from investors across the region, sharing experience and expertise, helping startups to enter both Central Asian and global markets,” MA7 Angels Club Murat Abdrakhmanov.

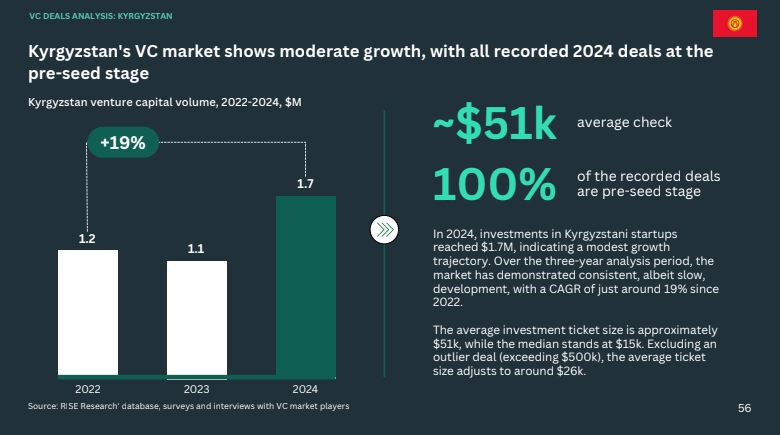

In 2024, investments in Kyrgyz startups reached $1.7 mln. Over the three-year period of analysis, the market showed stable development with a compound annual growth rate (CAGR) of about 19% from 2022.

All venture deals recorded for 2024 in the country belong to the pre-seed stage, which affects the average investment size: in 2024 it amounted to $51 thousand. If we exclude a single deal exceeding $500 thousand, the average size of a venture round adjusts to $26 thousand.

“The venture capital market in Central Asia is showing impressive growth, and I am proud that our portfolio startups are important dots on this map. Our investments and support have already helped funders enter new markets. And our new fund in Spain is open to startups growing in Europe and globally” - Yerik Aubakirov, CEO EA Group.

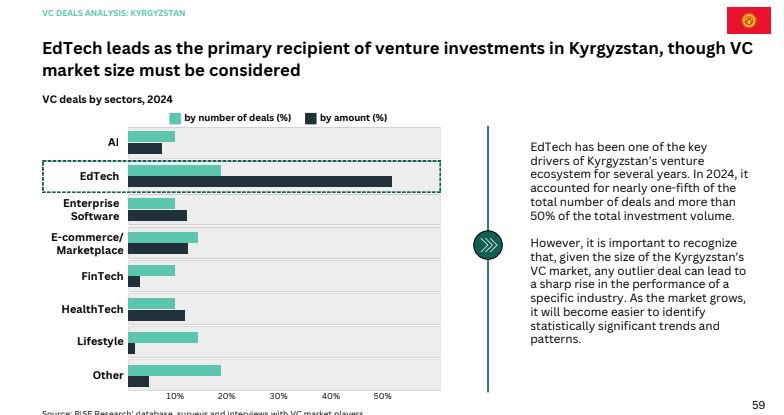

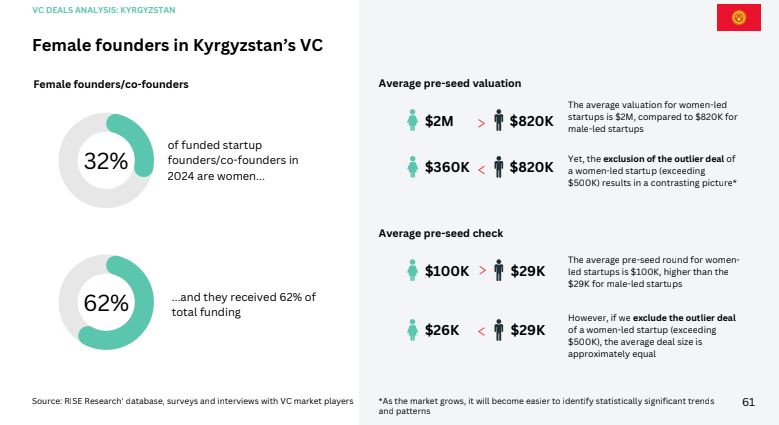

EdTech remains a key industry, accounting for 20% of all deals and more than 50% of total venture capital investment. In addition, Kyrgyzstan is characterized by high activity of female founders. In 2024, startups founded by women accounted for nearly a third of all deals and two-thirds of total investments raised.

“We are happy to see the first fruits of our work and observe the active development of the startup ecosystem, several generations of founders from the Kyrgyz Republic have grown up during this time. I am sure that the processes of integration between our ecosystems in the region and bridges to the best global ecosystems contribute to the emergence of high-profile global success stories from our region” - Jyldyz Isabekova, Country Director of Accelerate Prosperity.

Yelzhan Kushekbayev, business angel and CEO of MA7 Angels Club, notes that the results of the report emphasize the growing potential of Central Asia.

“In MA7 Angels Club, investors take part in shaping the region's technology landscape, voting with capital for the most promising ideas and solutions,” - Yelzhan Kushekbayev, business angel, CEO MA7 Angels Club.

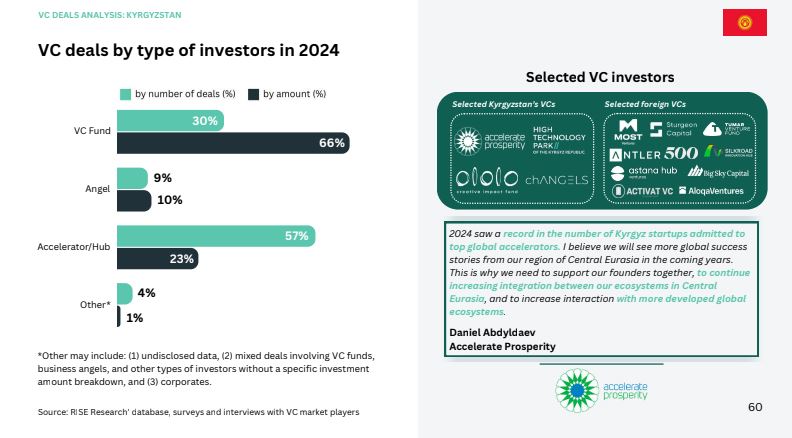

Gas pedals and hubs are the leaders of the venture capital market in Kyrgyzstan in terms of the number of committed investments (over 50%), but the bulk of the volume came from venture capital funds (66%), most of which are located abroad.

“Central Asia is strengthening its position in innovation and venture capital. BGlobal Ventures facilitates quality growth of startups through funding, training and development of the venture ecosystem, connecting them with regional and international partners. Our priority is a sustainable market that drives technological progress and global integration” - Nurzhan Kadirkey, CEO of BGlobal Ventures.

Despite modest absolute figures, the venture capital market in Kyrgyzstan shows signs of stable development. Growth is expected to continue in the coming years, provided that the investment climate continues to improve and the government and international organizations continue to support the startup ecosystem.